How to Invest in Anticipation of Hurricane Season: A Complete Guide

When How to Invest in Anticipation of Hurricane Season approaches, it doesn’t only disrupt communities; it also affects economies, presenting both risks and opportunities for investors. Savvy investors can position themselves to minimize losses and potentially gain from strategic investments during this turbulent period. Understanding how hurricanes impact various sectors and markets is crucial to building a resilient investment portfolio. This guide will cover the essential strategies, sectors, and timing to help you invest in anticipation of hurricane season effectively.

Understanding Hurricane Season’s Impact on Investments

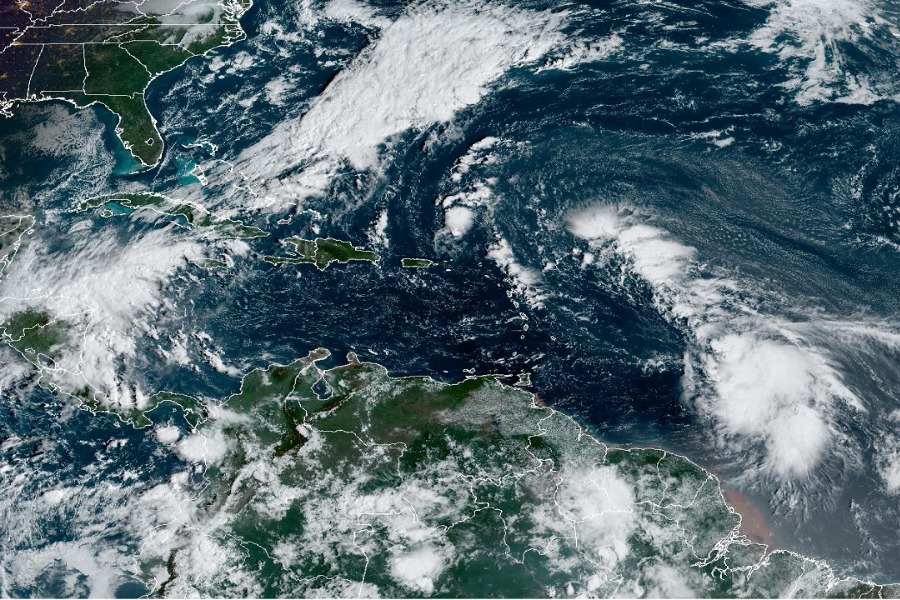

The Atlantic How to Invest in Anticipation of Hurricane Season typically runs from June 1 through November 30, peaking between mid-August and the end of October. During this time, storms affect areas such as the Caribbean, the Gulf of Mexico, and the Eastern U.S. coastlines. Hurricanes damage infrastructure, utilities, and properties, leading to economic downturns in the affected areas. However, from an investment perspective, this predictable event allows for targeted strategies in sectors that are significantly impacted by storms, providing potential opportunities for profit.

Key Sectors Affected by Hurricane Investments

Hurricanes have a varied impact on industries, which creates unique opportunities for investors in certain sectors. Here’s how hurricanes typically affect these key industries:

- Insurance: The insurance sector is one of the most affected by hurricanes. Increased claims due to damage can negatively impact insurers in the short term. However, after the immediate crisis passes, insurers often raise premiums to recoup losses, making insurance stocks a potentially rewarding long-term investment.

- Construction: Hurricanes cause widespread damage to homes, buildings, and infrastructure, leading to increased demand for construction services. Companies involved in rebuilding and repairs typically see a surge in business after storms, making this sector a prime candidate for investment.

- Home Improvement: Similar to the construction industry, home improvement stores like Lowe’s and Home Depot often experience an uptick in business as people repair their homes after storm damage. Stocks in this sector can perform well during How to Invest in Anticipation of Hurricane Season.

- Energy: The energy sector, particularly oil and gas production in the Gulf of Mexico, is highly vulnerable to disruptions during How to Invest in Anticipation of Hurricane Season. Storms can halt production, leading to supply shortages and price spikes. Energy stocks often see increased volatility during this period, presenting both risks and rewards for investors.

- Retail: Retailers, particularly those that sell essential goods such as food, water, and emergency supplies, often see a spike in demand ahead of hurricanes. However, supply chain disruptions can also negatively impact certain retailers, so investors should be selective in this sector.

Economic and Market Reactions to Hurricanes

Historically, hurricanes have caused significant market fluctuations in affected regions. Energy prices often spike due to disruptions in oil and gas production, leading to increased volatility in energy stocks. On the other hand, insurance companies face a surge in claims, but their stock performance often recovers over time as they adjust premiums and secure reinsurance agreements to mitigate risk.

Short-Term Impact

In the immediate aftermath of a hurricane, there’s typically a drop in stock prices for companies directly affected by the storm, particularly those in insurance and energy sectors. This short-term volatility creates both risks and opportunities for investors. While some companies may suffer, others — such as construction and home improvement firms — often experience an increase in demand, making them attractive short-term investment targets.

Long-Term Impact

Over the long term, companies in affected sectors, especially insurance and energy, tend to recover. Insurers, in particular, often raise premiums to offset losses, leading to improved profitability in the years following major hurricanes. This makes insurance stocks a potentially lucrative investment for those with a long-term perspective.

Sectors and Stocks to Watch During Hurricane Season

If you’re looking to invest during How to Invest in Anticipation of Hurricane Season, there are specific sectors and stocks that typically outperform or experience heightened activity. Below are some key areas to consider:

- Insurance Companies: Companies such as Allstate, Travelers, and Berkshire Hathaway’s reinsurance arm tend to see increased volatility during How to Invest in Anticipation of Hurricane Season due to the rise in claims. However, these firms often recover by raising premiums in the long term.

- Construction and Home Improvement: Construction firms and home improvement retailers like Lowe’s and Home Depot often see increased business after hurricanes as people rebuild and repair homes and buildings.

- Energy Companies: Energy giants such as ExxonMobil and Chevron often experience volatility due to disruptions in oil and gas production in hurricane-prone areas like the Gulf of Mexico. However, these disruptions can lead to higher energy prices, which benefits energy stocks in the long run.

- Retail: Retailers such as Walmart and Costco, which sell essential goods like food and water, often experience a surge in demand ahead of hurricanes, making them a good short-term investment.

Investing in Hurricane ETFs and Weather-Related Funds

For investors seeking a broader, less hands-on approach, Exchange Traded Funds (ETFs) focused on hurricane-affected sectors can be a good option. One example is the Invesco Dynamic Building & Construction ETF (PKB), which invests in companies that benefit from increased construction activity following hurricanes. These ETFs provide diversification and allow investors to capitalize on How to Invest in Anticipation of Hurricane Season without having to pick individual stocks.

Insurance ETFs

The insurance sector is also home to several ETFs that can help investors gain exposure to the industry without picking individual stocks. Some of these funds include the SPDR S&P Insurance ETF (KIE), which holds a diversified portfolio of insurance companies, including those involved in reinsurance, which helps spread risk among multiple insurers.

Energy and Utility ETFs

For investors looking to benefit from fluctuations in energy prices during How to Invest in Anticipation of Hurricane Season, energy-focused ETFs like Energy Select Sector SPDR Fund (XLE) offer exposure to oil and gas companies. Additionally, utilities ETFs such as Utilities Select Sector SPDR Fund (XLU) can provide a more stable option, as utility companies often play a key role in recovery efforts after storms.

Critical Considerations for Investors Before Hurricane Season

Investing in anticipation of How to Invest in Anticipation of Hurricane Season requires careful planning and timing. There are several key factors to consider before making your investment decisions.

1) Timing Your Investments Ahead of the Peak Season

Timing is everything when it comes to investing during How to Invest in Anticipation of Hurricane Season. The peak period for hurricanes is typically from mid-August to late October, but investors often begin positioning their portfolios in late spring to early summer. By investing ahead of the peak season, you can capitalize on market shifts as hurricanes develop.

Weather forecasts and predictions from agencies like the National Hurricane Center can help investors anticipate when storms are likely to hit, giving them time to adjust their portfolios accordingly.

2) Balancing Risk and Reward During Hurricane Season

Investing during How to Invest in Anticipation of Hurricane Season can be volatile, so it’s important to balance risk and reward. While sectors like energy and insurance may see significant short-term fluctuations, diversifying your portfolio with more stable assets, such as utilities or infrastructure companies, can help mitigate risk.

3) Hedging Strategies

Hedging strategies, such as investing in inverse ETFs or options, can also help protect your portfolio from downside risk during How to Invest in Anticipation of Hurricane Season. Inverse ETFs, such as the ProShares Short S&P500 (SH), are designed to move in the opposite direction of the market, providing protection during periods of market downturn.

Awareness of Regional and Sectoral Effects

Hurricanes tend to have a more significant impact on companies operating in specific regions, particularly those in the Gulf of Mexico and along the Eastern Seaboard. Investors with exposure to companies in these areas should be particularly cautious during hurricane season.

On the other hand, companies with national or global operations may be less affected by localized storms, providing a safer option for investors seeking to avoid regional risks.

Conclusion

Investing in anticipation of How to Invest in Anticipation of Hurricane Season requires a thoughtful approach, balancing potential risks with the rewards of sectors that benefit from storm-related disruptions. By focusing on key sectors such as insurance, construction, home improvement, and energy, investors can position themselves to capitalize on the economic shifts that hurricanes create.

The timing of investments is crucial — entering the market before the peak of the How to Invest in Anticipation of Hurricane Season allows investors to anticipate market shifts and take advantage of price movements. Additionally, diversifying your portfolio and utilizing hedging strategies can help protect against the volatility that hurricanes often bring to the market.

In the end, those who prepare in advance and remain flexible in their investment strategies are best positioned to profit from the opportunities that How to Invest in Anticipation of Hurricane Season presents. By understanding the economic impact of hurricanes and targeting the right sectors, you can navigate the storms and come out on top.